Claiming expenses if you worked from home due to COVID-19 (T777S and TP-59.S-V)

If you worked from home due to COVID-19, you can claim your home office expenses. The Canada Revenue Agency (CRA) and Revenu Québec have released two new simplified methods to make it easier for you to claim your home office expenses:

-

Temporary flat (fixed) rate method – You can claim $2 for each day you worked from home, up to a maximum of $500, to cover your home office expenses.

-

Detailed method – You can claim the amount you actually paid for your home office expenses.

Note: You can’t use these methods to claim your expenses if you regularly work from home (not just because of COVID-19) and/or have other employment expenses to claim (like motor vehicle expenses). You’ll need to use the traditional method instead.

The method you use depends on how much you paid in expenses to work from home this year and if you have supporting documents such as receipts and a signed T2200S form (and TP-64.3-V, if you’re a Québec resident) from your employer. You can also use CRA’s calculator to see how much you’ll be able to claim with each method.

Here’s a quick comparison of all the methods with which you can claim your expenses:

| Temporary flat rate method | Detailed method | Traditional method |

|

Use this method if: You’re an eligible employee who worked from home in 2022 due to COVID-19 and:

I want to find out more about the temporary flat rate method Where do I claim my expenses using the temporary flat rate method? |

Use this method if: You’re an eligible employee who worked from home in 2022 due to COVID-19 and:

I want to find out more about the detailed method Where do I claim my expenses using the detailed method?

|

Use this method if : You’re an eligible employee who regularly works from home and: |

You can use the temporary flat rate method if, as an employee, you spent at least 50% of your hours working remotely for at least 4 consecutive weeks in 2022. This includes full-time and part-time hours.

You can claim $2 for each day you worked from home, up to a maximum of $500. In other words, you can claim up to 250 days.

Note: Vacation days, statutory holidays, sick leave days, and other days off don’t count towards the one-month period.

For example, if you worked from home Monday to Friday during 1st April 2020 to 15th May 2020 and took 2 days off, the total number of days you worked from home would be:

April 1st to May 15th = 33 weekdays

33 days – 2 vacation days = 31 days

31 days – 1 statutory holiday = 30 days worked from home

You won’t need a signed T2200S form (and TP-64.3-V if you’re a Québec resident) from your employer, or receipts to support your expense claim.

More than one person can also claim the same workspace, and you won’t need to divide the amount between you.

Follow these steps in H&R Block’s 2022 tax software:

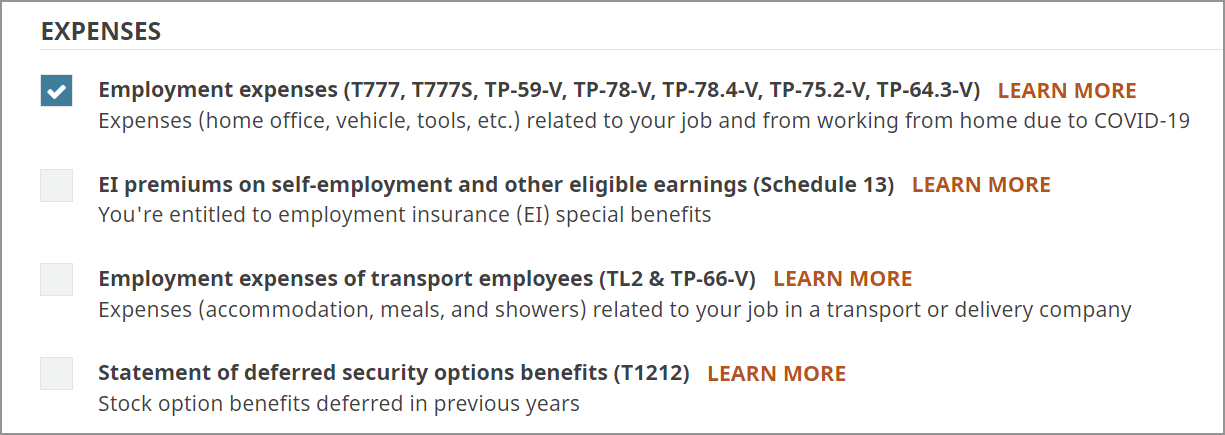

- On the left navigation menu, under the Credits & deductions tab, click Tax Topics.

- In the Claim your credits, deductions, and expenses section, click Continue.

- Under the Employment Expenses box, click the Add This Topic button.

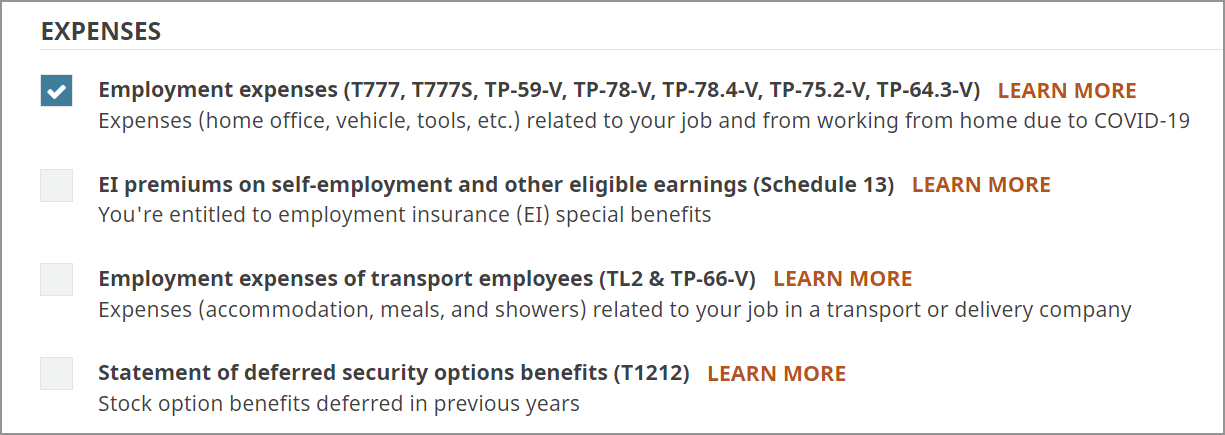

- Click Employment on the left navigation menu.

- Under the EXPENSES heading, select the checkbox labelled Statement of employment expenses (T777 & T777S) and click Continue.

Note: If you're a Québec resident, this page is called Employment expenses (T777, T777S, TP-59-V, TP-78-V, TP-78.4-V, TP-75.2-V, TP-64.3-V).

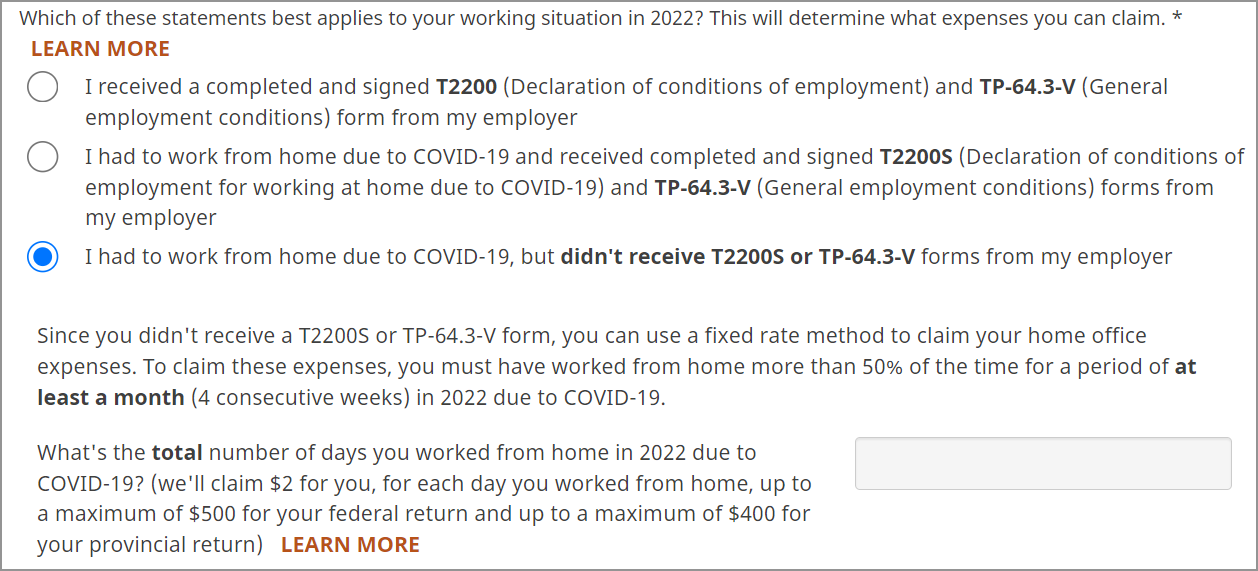

- On the Employment Expenses page, select the following option in response to Which of these statements best applies to your working situation in 2022?:

- I had to work from home due to COVID-19, but didn't receive a T2200S form from my employer

OR

(Note: Only Québec residents will see this option.)

I had to work from home due to COVID-19, but didn't receive T2200S or TP-64.3-V forms from my employer

- Enter the total number of days you worked from home in 2022 and click Continue.

If you want to claim the amount you actually paid for your home office expenses instead of a flat rate, you’ll need to use the detailed method. The amount you paid can be used to reduce the taxes you owe when you file your 2022 return.

To be eligible you must meet the following conditions:

-

As an employee, you spent at least 50% of your hours working remotely for at least 4 consecutive weeks in 2022. This includes full-time and part-time hours.

-

You were required to pay for your home office expenses which were used directly for your work.

-

You received a completed and signed T2200S from your employers (and TP-64.3-V, if you’re a Québec resident).

Eligible expenses include:

-

Long distance calls you made for work

-

Home internet access fees

-

Rent paid for your house or apartment

-

Utilities such as electricity and heat

-

Office supplies

If you earned commission in 2022, you can claim additional expenses, such as your property taxes and home insurance. For a full list of expenses that you can claim using the detailed method, visit the CRA website.

You can’t claim the following expenses:

-

New appliances or furniture for your home office

-

Personal electronics (for example, a new cellphone or tablet)

-

Computer accessories (for example, a monitor or webcam)

-

Your mortgage interest, mortgage payments, capital expenses, or capital cost allowance

Note: You also can’t claim any expense that was or will be reimbursed by your employer. Visit the CRA website for a full list of expenses you can’t claim.

To claim your home office expenses using the detailed method, you’ll need all of the following:

-

Receipts for your eligible expenses

-

A signed T2200S form from your employer

-

A signed TP-64.3-V form from your employer (if you’re a Québec resident)

The amount you can claim is based on:

-

Your eligible home office expenses

-

The square footage in your home used for your home office or workspace

-

The total square footage of your home

-

The number of hours you used your home office/workspace for work

Follow these steps in H&R Block’s 2022 tax software:

- On the left navigation menu, under the Credits & deductions tab, click Tax Topics.

- In the Claim your credits, deductions, and expenses section, click Continue.

- Under the Employment Expenses box, click the Add This Topic button.

- Click Employment on the left navigation menu.

- Under the EXPENSES heading, select the checkbox labelled Statement of employment expenses (T777 & T777S) and click Continue.

Note: If you're a Québec resident, this page is called Employment expenses (T777, T777S, TP-59-V, TP-78-V, TP-78.4-V, TP-75.2-V, TP-64.3-V).

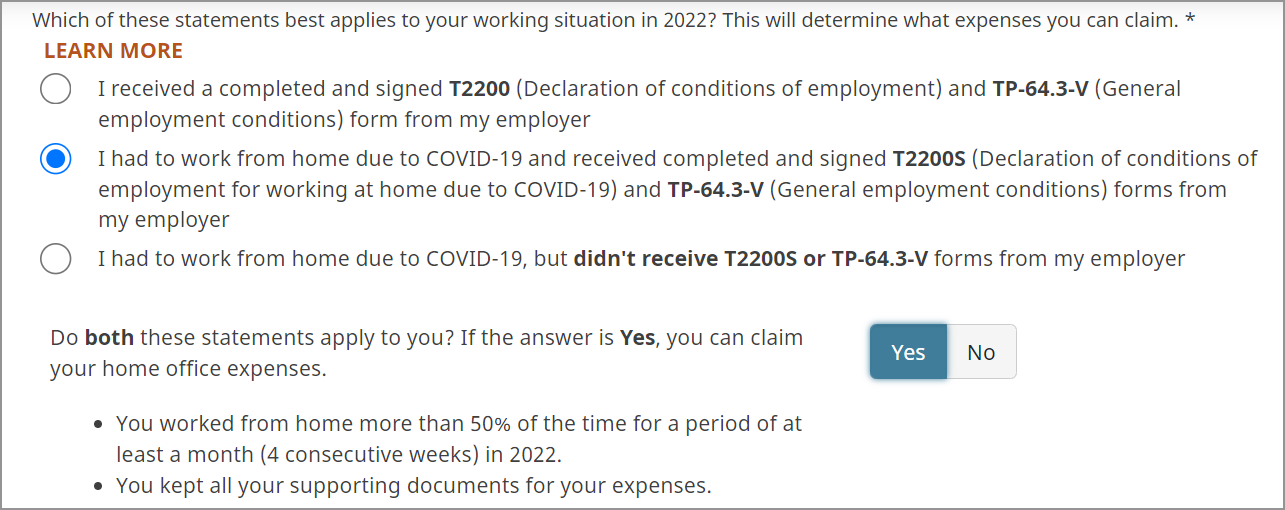

- On the Employment Expenses page, select the following option in response to Which of these statements best applies to your working situation in 2022?:

- I had to work from home due to COVID-19 and received a completed and signed T2200S (Declaration of conditions of employment for working at home due to COVID-19) form from my employer

OR

(Note: Only Québec residents will see this option.)

I had to work from home due to COVID-19 and received completed and signed T2200S (Declaration of conditions of employment for working at home due to COVID-19) and TP-64.3-V (General employment conditions) forms from my employer

- Select Yes in response to Do both these statements apply to you? If the answer is Yes, you can claim your home office expenses, then click Continue.

- When you arrive at the Home office expenses page, enter your information into the tax software.

If you regularly work from home (not just because of COVID-19) and you received a signed T2200 from your employer (and a TP-64.3-V, if you’re a Québec resident), you’ll need to use the T777: Statement of employment expenses (and TP-59-V: Employment expenses of salaried employees and employees who earn commissions, if you’re a resident of Québec) form instead.

You’ll be able to claim all eligible employment expenses (not just your home office expenses) that you paid and weren’t reimbursed by your employer.

Visit the Statement of employment expenses (T777 and TP-59-V) help article to learn more.