How to fix warnings and errors in your tax return

When you get to the end of your tax return, you might be presented with some errors or warnings that you need to review. Here’s what you need to know.

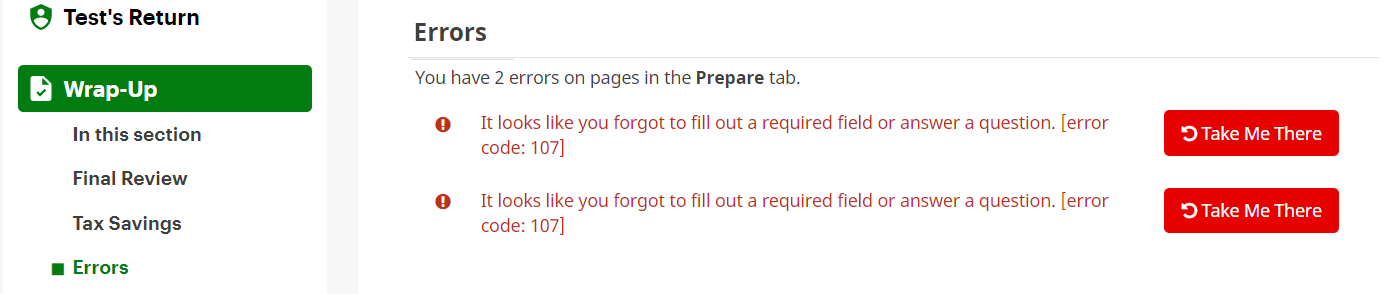

Errors need to be fixed in your return before you file; you cannot NETFILE a return if you have existing errors. They will be highlighted in red text, on the ERRORS page under the Wrap-Up tab in H&R Block’s DIY tax software.

You can click the Take Me There button to go to the error, correct the information, and then return back to the ERRORS screen to continue updating your return until all the errors are fixed.

Note: Switching browsers or using Incognito mode on your browser will not fix an error. The only way to correct the error is to update the information causing the error in your tax return.

On the slim chance that your error doesn’t have a Take Me There button, you can navigate to the error by using the navigation tabs and icons at the top of your screen. The ERRORS page will tell you which tab the error is on (e.g. Get Started tab), and you can click that tab from the top of your screen. Once there, you’ll see a red exclamation mark icon, indicating where you have the error.

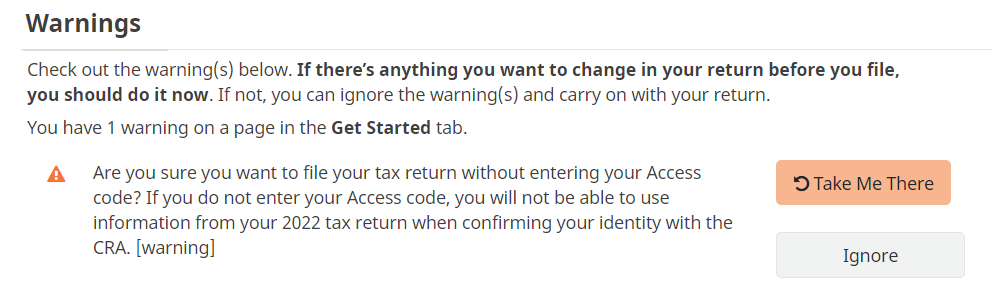

Warnings should be reviewed before you file your return. However, if they don’t apply to you or if you want to ignore them, you can continue to NETFILE without correcting them. Warnings will be highlighted in orange text, on the ERRORS page under the Wrap-Up tab in H&R Block’s DIY tax software.

You can click the Take Me There button to go to the warning, update your information, and then return back to the ERRORS screen to continue updating your return until all the warnings are fixed.

Note: Switching browsers or using Incognito mode on your browser will not fix a warning. The only way to correct the warning is to update the information causing the warning in your tax return.