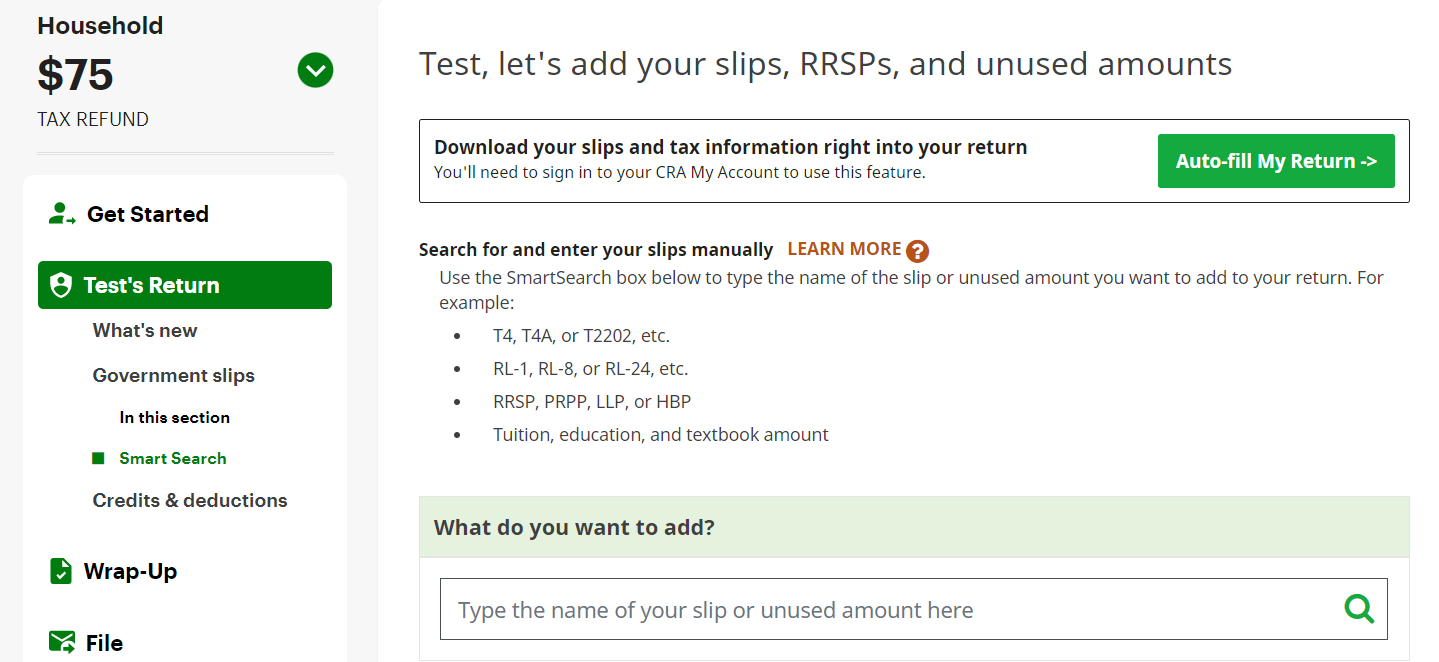

What is the Smart Search feature and how does it work?

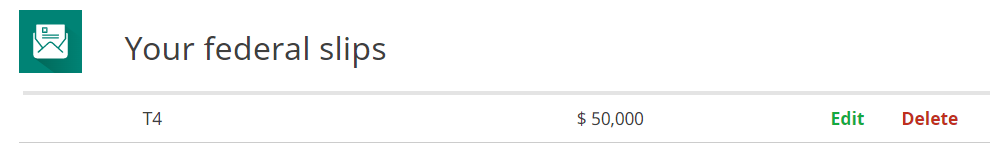

The Smart Search feature in H&R Block's tax software lets you enter information from your federal slips (like your T4), Québec relevé slips (like your RL-1), RRSP or PRPP contributions, repayments to the home buyers’ plan and lifelong learning plan, and your unused amounts from previous years all in one convenient location.

The way it works is simple:

-

On the left navigation menu, click the Government slips tab, then Smart Search.

- Enter the name of your slip or receipt into the search box.

Remember to include special characters if you’re entering the name of a specific form. For example, if you enter the name of the T4A-RCA slip without the hyphen, and type “T4ARCA” or “T4ARCA” instead, your search won’t generate the results you’re looking for.

Note: You can also search for your slips by entering related keywords. For example, you can type "job", "salary", or "wages" into the search field if you'd like to enter the information from your T4 and/or your RL-1.

- Select the desired item or press Enter to continue.

- You’ll be directed to the appropriate page within the software to enter your information.

Note: The Smart Search feature can only be used to enter the information from the slips and receipts you received from your employer, the government, your bank, or another organization. Anything else, like credits, deductions, and expenses (things like the disability supports deduction and medical expenses) can all be entered in the Credits & deductions section of the software.

No. For the credits and expenses that you’re claiming on behalf of a dependant, click the name of the dependant located on the left-hand navigation panel. Once there, you can select the situations that applied to your dependant in 2022 and claim the relevant credit and deduction amounts.