Where do I find my PDF tax return?

If you want to see your tax return before you file it, you can view your PDF tax return summary on the Tax summary page by clicking the Wrap-Up tab on the left navigation menu, then SUMMARY. This document provides you with an overview of the amounts that were used to calculate your refund or tax owing.

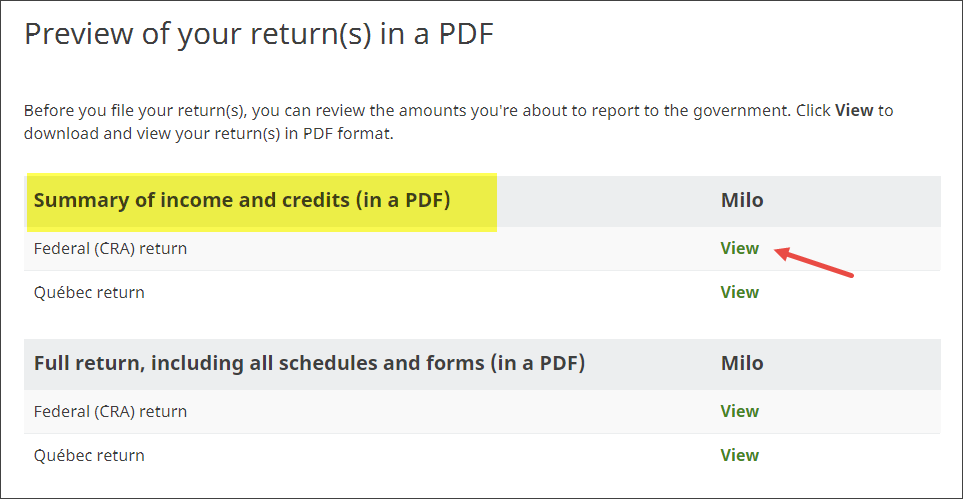

To see your PDF tax summary:

- On the left navigation menu, under the Wrap-Up tab, click SUMMARY.

- On the Tax summary page, under Summary of income and credits (in a PDF), click the View link next to the return you want to see.

- A summary of your tax return downloads to your computer as a PDF file.

You can open the downloaded PDF by clicking the icon that appears at the bottom of your screen or by searching the Downloads folder of your computer. The downloaded file will be named similarly to one of the following examples:

Milo_CRA_2022_summary.pdf

Milo_RQ_2022_summary.pdf

Note: Remember, you can always go back and make changes to your return by clicking the Back button on the Tax summary page or by using the tabs at the top of the page to navigate to a previous section.

The detailed version (Full return, including all schedules and forms (in a PDF)) of your tax return shows you line-by-line, the federal and provincial forms and schedules you’ve completed so that you can be confident that you haven’t missed anything before you send your return to the government.

To see your detailed tax return before you file it, you’ll need to upgrade to either our DELUXE, PREMIER, or SELF-EMPLOYED package. You’ll be able to access and review your detailed tax return by downloading it from the Tax summary page under the Wrap-Up tab.

If you want to make any changes to your return, you can always go back to a previous section by clicking the Back button on the Tax summary page or by using the tabs at the top of the page.

Yes. Once you save your downloaded return, you’ll be able to print it.

If you’ve decided to mail-in a copy of your return instead of filing it electronically using NETFILE, you’ll be able to download a PDF copy of your return on the File tab. You can then print it and send it to the Canada Revenue Agency (CRA) and/or Revenu Québec. Keep in mind, once you’ve chosen to file your return by mail on the File tab, you can’t NETFILE your return. For more information, check out our help article, Where do I find the mail-in version of my tax return (PDF)?.