Capital Gains or Losses (Schedule 3 and Schedule G)

You’ll need to use the federal Schedule 3 form to report any capital gain (or loss) you have from the disposition (sale or transfer) of a capital property – specifically, shares, bonds, debts, land, or buildings – and if you want to claim a capital gains reserve.

You can even have a capital gain or loss if you’re considered to have sold capital property. This can happen if you:

- Give property (other than cash) as a gift

- Settle a debt someone else owes you

- Transfer property to a trust

- Exchange properties

- Owned property that was destroyed or stolen

Regardless of whether the disposition of a capital property results in a gain or a loss, you have to file a tax return to report the transaction, even if you aren’t required to pay tax. This is also true if you’re claiming a capital gains reserve.

Note: If you’re a resident of Québec, you’ll also need to complete Schedule G. Fortunately, both the Schedule 3 and Schedule G are combined in H&R Block’s tax software.

You can report the sale or transfer of the following types of capital property on the Schedule 3 and Schedule G page:

- Qualified small business corporation shares

- Qualified farm or fishing property

- Publicly traded shares, mutual fund units, deferral of eligible small business corporation shares and other shares

- Real estate, depreciable property, and other properties

- Bonds, debentures, promissory notes, and other similar properties

- Virtual currency transactions (cryptocurrency, tokens, etc.)*

- Other mortgage foreclosures and conditional sales repossessions

- Personal-use property

- Listed personal property (LPP)

- Resource property

*Virtual currency transactions – The government defines virtual currency as “Digital currency that can be used to purchase goods and services or engage in speculation, whose legal value is not generally recognized by the state.” You might have a deemed disposition of virtual currency if you used virtual currency (such as cryptocurrency) to:

- buy goods or services

- convert it to money

- exchange it for another virtual currency or

- make a donation

If you have a capital gain, you might be able to:

- defer part of the capital gain by claiming a reserve or

- offset all or a part of the gain by claiming a capital gains deduction.

Generally speaking, if you had an allowable capital loss in a year, you have to apply it against your taxable capital gain for that year.

If you still have a loss, it’s used to calculate your net capital loss, which you can use to reduce your taxable gain in any of the past 3 years or in a future year.

Generally speaking, you can’t split capital gains with your spouse (or common-law partner, if applicable) in order to reduce your tax payable. This is due to the Attribution rules put in place by the Canada Revenue Agency (CRA). These rules state that if you transfer capital property to your spouse, any capital gains (or losses) that result from the disposition of that property will be taxed in your hands rather than your spouse’s.

However, if you and your spouse purchased the capital property jointly, you can split the capital gains based on the proportion of each person’s investment. Let’s say you and your spouse bought a cottage a few years ago and each of you paid 50% of the purchase price. In that case, you’ll be able to split the capital gains that arise from the sale of the cottage, equally. The same would also apply to the adjusted cost base.

Starting 2019, if as a member of a partnership you sold your interest in the partnership, any capital gains from this disposition will be taxed at the 100% inclusion rate. This means, the full amount of your capital gains from this disposition will be used to calculate your total capital gains amount for the year.

Follow these steps in H&R Block’s 2022 tax software:

Note: If the type of property that you sold or disposed of was your principal residence, you’ll also need to complete the Principal residence designation (T2091(IND)/Schedule 3) page in H&R Block’s tax software.

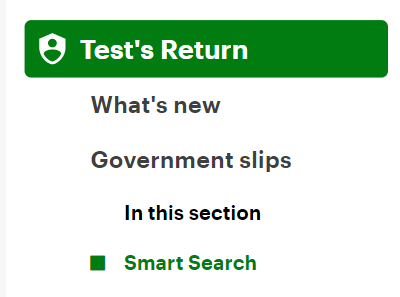

- On the left navigation menu, under the Credits & deductions tab, click Tax Topics.

- In the Claim your credits, deductions, and expenses section, click Continue.

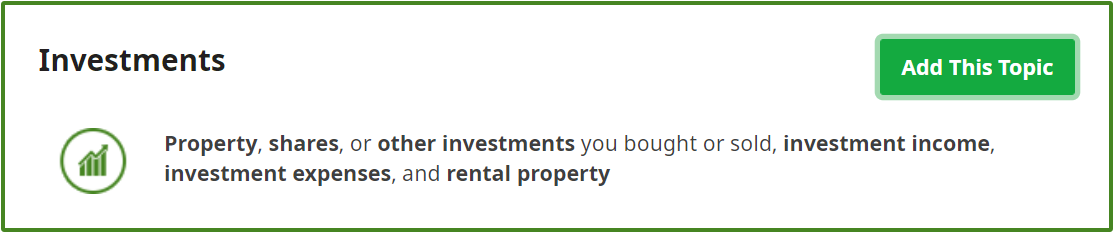

- In the Investments box, click the Add This Topic button.

- Under the BOUGHT/SOLD SECURITIES OR OTHER PROPERTY heading, select the checkbox labelled Capital gains and losses (Schedule 3 & Schedule G), then click Continue.

- When you arrive at the Capital gains and losses page, enter your information into the tax software.

Before you begin completing this page, remember to enter all your slips (such as the T3, T5, T5008, T5013, T4PS, RL-1, RL-15, and RL-18) in your return first. To add a slip, on the left navigation menu, click the Government slips tab, then Smart Search.

Enter the slip name (example, T3) in the search field and either click the highlighted selection or press Enter to continue.

Once you’ve entered your slips, H&R Block’s tax software will automatically transfer the relevant information and amounts to your Schedule 3 and Schedule G. If you want to add other information on this page, remember that your Schedule 3 and Schedule G (if applicable) will be customized depending on the type of capital property you sold or transferred. Some of the information you’ll need on hand to complete this page includes:

- Address or legal description of the property: The legal description of the property represents the location of the property based on a land survey such as a township survey, district lot, etc.

- Proceeds of disposition: This is the amount you received from the sale of your capital property.

- Adjusted cost base (ACB): This is the cost of a property plus any expenses you paid to acquire it (such as commissions and legal fees), plus any additions or upgrades made to property. Keep in mind, you cannot add current expenses, such as maintenance and repair costs, to the cost base of a property. However, if the repairs are made to the property because of you want to sell it or it was a condition of sale, the repairs are capital expenses and can be added to the ACB of the property.

- Expenses you paid to sell the property: These expenses include fixing-up expenses, finders' fees, commissions, brokers' fees, surveyors' fees, legal fees, transfer taxes, and advertising costs.

- Capital gains reserve amount: When you sell something, you typically receive payment in full at the time of the sale. When it comes to capital property, you might receive payment over the course of a few years. In this case, you can defer a portion of the capital gain by claiming a reserve.

For example, if you sold a capital property for $100,000, you might receive $60,000 at the time of the sale and the remaining $40,000 over the course of the next 4 years. You might be able to claim a reserve in this case, which allows you to report a portion of the capital gains in the year you received the payment.

Note: You can’t claim a reserve if you were in any of the following situations:

- You were not a resident of Canada at the end of 2022 or at any time in 2023

- You were Exempt from paying tax at the end of 2022 or at any time in 2023

- You sold your capital property to a corporation that you control in any way

To deduct a reserve from you capital gains, you’ll need to also complete the T2017: Summary of reserves on dispositions of capital property form. Refer to this form for more information on how to calculate the maximum amount you can deduct as a reserve and the number of years you can claim the reserve. You can find the T2017 page in H&R Block’s tax software under the Pension plans and investments page on the Credits & deductions tab.

- Capital gains from the sale of any eligible small business corporation shares that you want to defer: You might be able to defer capital gains on certain small business investments disposed in the year. This deferral applies to dispositions where you use the amount from the sale to acquire another small business investment. The adjusted cost base (ACB) of the new investment is reduced by the capital gain deferred from the initial investment.

The capital gains deferral applies only to eligible small business corporation shares. The eligible small business corporation shares have the following characteristics:

- These are common shares issued by the corporation to you, the investor

- They are issued by a corporation that’s an eligible small business corporation* at the time the shares were issued

- The total carrying value of the assets of the corporation and related corporations can’t be more than $50 million immediately before, and immediately after, the share was issued and

- While you hold the shares, the issuing corporation is an eligible active business corporation.

To be able to defer the capital gain, you must have held the eligible small business corporation shares for more than 185 days from the date you acquired them. The replacement shares must be acquired at any time in the year of the disposition or within 120 days after the end of that year.

*An eligible small business corporation is a Canadian-controlled private corporation, where all or substantially all of the fair market value of its assets is used mainly in an active business that is carried on in Canada by the corporation or an eligible small business corporation related to it.

Note: If the type of property that you sold or disposed of was your principal residence, you’ll also need to complete the Principal residence designation (T2091(IND)/Schedule 3) page in H&R Block’s tax software.