T5: Statement of Investment Income

Your T5: Statement of investment income slip reports the interest, dividends, and certain sources of foreign income that you earned during the year.

If you’re a resident of Québec, you’ll also be issued a Relevé 3: Investment income (RL-3) slip. If you’re filing a Québec return, be sure to enter information from both your T5 and your RL-3 slips into the tax software.

Generally speaking, a bank or financial institution will only issue you a T5 or RL-3 slip (if applicable) your investment income exceeds $50. If you didn’t receive a T5 or RL-3 slip, or if the amount you earned was less than $50, you can report the amounts you earned by completing Statement of investment income, carrying charges, and interest expenses page in the software.

Note: If any amounts are earned in foreign currency, make sure you convert them into Canadian dollars.

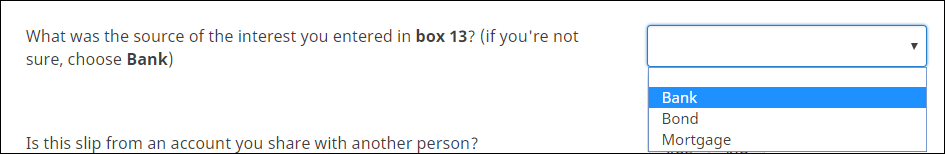

If you have an amount in box 13 of your T5 slip, you’ll need to select the source of this income. For most people, this amount is earned as interest through your bank account. If you’re unsure of the source for this income, select Bank in the drop-down menu. While your selection will not impact your tax owing or refund amount, it is required by the Canada Revenue Agency (CRA) for information purposes.

If the interest income reported in box 13 of your T5 slip is from more than one source, you’ll need to make 2 separate entries for your T5 in H&R Block’s tax software.

For example:

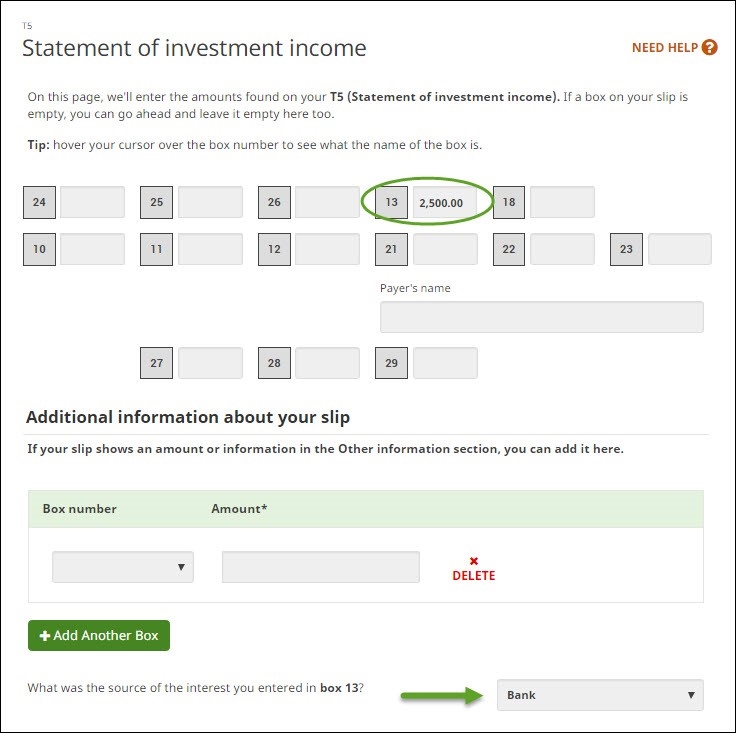

You received a T5 slip in 2022 that contained an amount of $5,000 in box 13 (interest from Canadian sources). Half of this income ($2,500) was earned through a bond that you purchased and the other half was earned as interest on your bank account. To correctly enter your information into H&R Block’s tax software, you’d need to follow these steps:

- Type T5 into the search field. Click the highlighted selection or press Enter to continue.

- In box 13, enter the portion of interest income that your earned from your bank account.

- In the Additional information about your slip section, select Bank from the dropdown menu to indicate the source of interest related to the amount you entered in box 13:

- At the bottom of the screen, click the +Add Another T5 button.

- Repeat steps 1 through 4 to report the amount related to the interest income you earned from the bond you purchased.

Follow these steps in H&R Block's 2022 tax software:

- Type T5 into the search field. Click the highlighted selection or press Enter to continue.

- When you arrive at the page for your T5, enter your information into the tax software.

If you also have an RL-3 slip to enter, repeat Step 1 above, type RL-3 in the search field and either click the highlighted selection or press Enter to continue. When you arrive at the Relevé 3: Investment income page, enter your information into the tax software.