Repaying COVID-19 benefits

In 2020, the federal government introduced emergency benefits to help Canadians get the financial relief they need during the COVID-19 pandemic. You might have received an emergency benefit, like the Canada Emergency Response Benefit (CERB), but later found out you weren’t actually eligible for it.

If you repaid COVID-19 support benefits in 2022, you can claim all or some of the amount you repaid on your 2022 return. Here’s what you need to know about claiming your COVID-19 support benefit repayments.

You’ll receive a letter from the Canada Revenue Agency (CRA) or Service Canada notifying you if you need to repay any COVID-19 support benefits you received.

If you had to repay federal COVID-19 benefits in 2022 that you received in 2020 or 2021, you can choose to claim a deduction for the repayment either on your 2022 return or on the return for the year you started to repay them. Note: this temporary measure only applies to 2022 and 2021 and only to federal COVID-19 benefits. It does not apply to provincial COVID-19 benefits or EI benefits.

If you want to claim a deduction on a prior-year return, you have to request an adjustment to that return. However, in the case of repayment of COVID-19 benefits, there is a new Form T1B Request to Deduct Federal COVID-19 Benefits Repayment in a Prior Year for allocating the repayment. This form allows you to choose which tax year(s) you would like to apply the deduction without having to request an adjustment to those returns. The form is submitted with your 2022 tax return and the prior-year returns will be adjusted automatically. The downside is that if Form T1B is completed, you cannot Efile your return – you can only paper-file it.

Important: When deciding which year to claim your deduction the amount you receive for benefits (ST/HST Credit, Canada Child Benefit and many provincial benefits etc.) could be affected since they depend on what your net income is.

If you repaid your COVID-19 emergency benefits in 2021 and you decide to claim the deduction in that year, your net income for 2021 will be lower and so your credits or benefits could increase for the July 2022 to June 2023 benefit period. This will also affect your net income in 2022, making it higher, which may reduce the benefits you receive in the July 2023 to June 2024 benefit period.

In February 2021, the government announced that self-employed individuals who mistakenly applied for the CERB based on their gross income (the amount you made before subtracting your work-related expenses) are no longer required to pay back their benefits.

This means you might not have to repay your CERB amounts if:

-

You’re self-employed

-

You earned at least $5,000 in 2019 before subtracting your expenses and

-

You meet the other eligibility requirements

If you already repaid your CERB amounts but you’re now considered eligible for the benefit, you can ask the CRA and Service Canada to give you back the amount you repaid by using the T180 (CERB reimbursement application for self-employed individuals) form. You can submit this form through your CRA My Account or by mail. Visit the CRA website for more information about the T180 form.

The amount of COVID-19 support benefits you repaid in 2022 will be reported on one of the following slips:

If you received COVID-19 support benefits through the CRA, you’ll receive a T4A slip showing how much you repaid. You’ll find the total amount of federal and/or provincial COVID-19 benefits you repaid in 2022 in box 201.

If you received federal COVID-19 support benefits through Service Canada, you’ll receive a T4E slip showing how much you repaid. You’ll find the total amount you repaid in 2022 in box 30.Since this box may also include repayments of EI benefits, you will receive a letter from Service Canada giving you the breakdown.

If you repaid COVID-19 benefits in 2022 that weren’t reported on a T4A or T4E slip, you’ll need to report the on the Special situations page in H&R Block's tax software.

To claim the COVID-19 benefit repayments reported on your T4A slip, follow these steps in H&R Block's tax software:

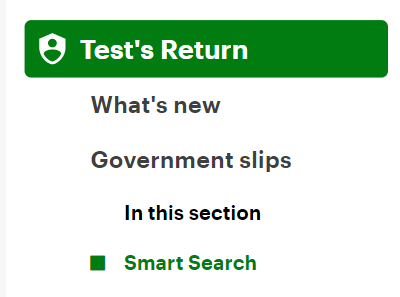

- On the left navigation menu, click the Government slips tab, then Smart Search.

- Type T4A in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the appropriate page for your T4A slip, enter your information into the tax software. Your COVID-19 repayment information will be found in box 201.

To claim the COVID-19 benefit repayments reported on your T4E slip, follow these steps in H&R Block's tax software:

To claim your COVID-19 benefit repayments on the Special Situations page, follow these steps in H&R Block's tax software:

- On the left navigation menu, under the Credits & deductions tab, click Required.

- Click the Special situations heading.

-

Enter your information into the tax software.