Manitoba Education Property Tax Credit

As a Manitoba resident, part of your rent or property tax is put towards funding schools. With the Manitoba education property tax credit (EPTC), you might be able to claim up to $437.50 either on your municipal property tax statement or through your income tax return for your contribution to the school system.

You can claim this credit if you were a resident of Manitoba at the end of the year and:

- You paid rent or school tax on your home in Manitoba during the year

- You were at least 16 years old at the end of the year

Note: If you have a spouse or a common-law partner, the person who claims the Manitoba school tax credit for homeowners and seniors’ school tax rebate must also be the one to claim the EPTC. If you and your spouse separated or divorced at the end of the year, both you and your spouse can claim the EPTC on your residences after the separation or divorce.

You can’t claim this credit if, during the year, you lived in someone else’s home who for 2022:

- Will claim you as a dependant

- Will claim a spousal amount for you, or to whom you’ll transfer your age amount or disability amount or

- Has received or will receive an education property tax credit

Note: You’ve already received the full EPTC benefit, if you’re 65 years of age or older at the end of the year, your family income was over $40,000, and the EPTC was applied to your 2022 property taxes in advance.

Your occupancy cost is the total of any of the following that apply to you:

- School taxes you paid for your principal residence in 2022

- Education property tax credit advance you received

- 20% of the total rent you paid in 2022

The school taxes amount is the school taxes you paid on your principal residence for 2022 minus any education property tax credit advance you received. If you live in rural Manitoba, you’ll need to enter the school taxes amount shown on your property tax statement.

You can claim up to a maximum of $437.50 for 2022.

If you rent and you paid for room and board, you can only claim the part you paid for your room. However, if you lived in a home which was also occupied by the homeowner, you can’t claim the EPTC.

As a homeowner, you can self-assess your eligibility for the tax credit and notify your municipality before your property tax statement is printed to have the credit applied to your property taxes starting that year. This is the EPTC advance.

If you notify your municipality after the property tax statement is printed, you can claim the EPTC on your tax return for that year. For subsequent tax years, the credit will be applied to your property taxes.

If you’re 65 or older at the end of the year, you might qualify for additional savings! For example:

- If you own and live in your home, you can claim up to an extra $470 with the Senior’s school tax rebate. The amount you can claim depends on your net family income - the rebate is reduced by 2% of net family income that’s over $40,000. A net family income of $63,500 or more is not eligible for the rebate.

- Seniors with a household income of $40,000 or less, you can claim up to an extra $400 from the EPTC

Note: If you’re eligible for the Senior’s school tax rebate, you no longer need a separate application to claim it. You’ll be able to make retroactive claims for up to three years, but no further back than the 2016 rebate

Follow these steps in H&R Block’s 2022 tax software:

Before you begin, make sure that you told us that you lived in Manitoba on December 31, 2022:

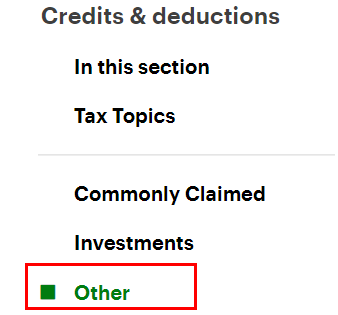

- On the left navigation menu, under the Credits & deductions tab, click Other.

- Under the SPECIFIC CREDITS FOR YOUR PROVINCE heading, select the checkbox labelled Manitoba education property tax credit.

- When you arrive at the page for your Manitoba education property tax credit, enter your information into the tax software.