Ontario Opportunities Fund

The Ontario Opportunities Fund gives Ontario residents the chance to help lower the province’s debt. Contributing is easy; if you’d like to contribute a portion of your tax refund to the fund, you can do so using H&R Block’s tax software.

Contributing to the Ontario opportunities fund can be useful to you too. If you contribute to the fund through your 2022 tax return, you will receive an official receipt which allows you to claim a donation tax credit on your 2023 tax return.

Note: You won’t be able to donate if your refund is less than $2 or if the Canada Revenue Agency (CRA) reduces your refund by $2 or more when it assesses your return.

Follow these steps in H&R Block's 2022 tax software:

Before you begin, make sure you’ve indicated that you lived in Ontario on December 31, 2022.

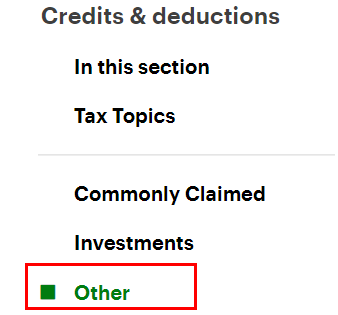

- On the left navigation menu, under the Credits & deductions tab, click Other.

- Under the SPECIFIC CREDITS FOR YOUR PROVINCE heading, select the checkbox labelled, Ontario opportunities fund then click Continue.

- When you arrive at the page for the Ontario opportunities fund, enter your information into the tax software.