Relevé 25: Income from a profit-sharing plan (RL-25)

You’ll receive an Relevé 25 (RL-25) slip from your employer or trustee if you’re the beneficiary of a profit-sharing plan and you live in Québec.

Note: Canadian residents living outside of Québec who’re enrolled in a profit-sharing plan will be issued a T4PS: Statement of Employee Profit-Sharing Plan Allocations and Payments instead.

Your RL-25 slip will report the dividends and capital gains (or losses) that have been allocated to you as a member of the plan, as well as any Québec income tax that’s withheld on these disbursements. Additional amounts that can also be found on your RL-25 slip include:

- Foreign income

- Foreign income tax on non-business income

- Foreign capital gains realized

- Capital gains (or losses) from qualified property

- Amounts on which Québec Pension Plan (QPP) contributions were made

- Amounts on which QPP contributions weren’t made

- Actual amount of eligible dividends

- Actual amount of ordinary dividends

Follow these steps in H&R Block's 2022 tax software:

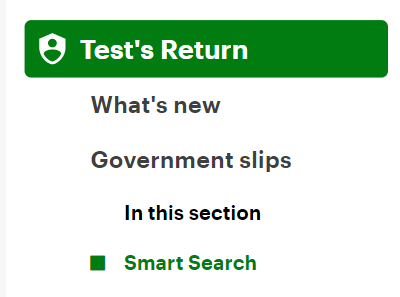

- Type RL-25 or relevé 25 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the RL-25 page, enter your information into the tax software.