Relevé 2: Retirement and annuity income

A Relevé 2: Retirement and annuity income slip is issued to residents of Québec who’ve either earned or transferred one or more of the following amounts:

- Retirement income

- Annuity income

- Amounts paid to a living spouse

- Amounts paid to someone after the death of an annuitant

- Contributions or premiums that a retired employee paid to a private health services plan

This list not complete. For more information regarding your RL-2 slip, refer to the Revenu Québec website.

Note: Certain types of accrued income, taxable benefits, and amounts you’ve transferred to another plan or fund won’t be reported on your RL-2 slip. For more information on these amounts, refer to the Revenu Québec website.

An RL-2 slip can be issued to you by any of the following:

- Registered Retirement Savings Plan (RRSP) and Registered Retirement Income Fund (RRIF) issuers

- Pooled Registered Pension Plan (PRPP) and Voluntary Retirement Savings plan (VRSP) administrators

- Deferred Profit Sharing Plan (DPSP) trustees

- Payers of retirement benefits, annuities, and income-averaging annuities

Note: If you received an RL-2 slip, you’ll also receive a federal T4AP slip.

If you haven’t received an RL-2 slip and you were expecting one, try:

- Contacting your financial institution directly to receive a duplicate

- Contacting Revenu Québec by calling 1 (800) 267-6299

- Logging into My Account on the Revenu Québec website or

- Visiting the Régie des rentes du Québec (RRQ) website

Follow these steps in H&R Block’s 2022 tax software:

- Type RL-2 or relevé 2 in the search field and either click the highlighted selection or press Enter to continue.

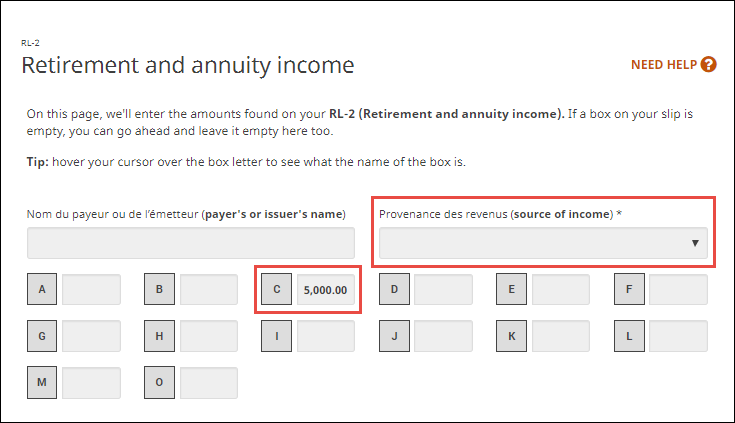

- When you arrive at the page for the RL-2 slip, enter your information into the tax software.

Note: If your RL-2 slip has an amount in Box C you’ll need to indicate the source of this income .