TP-1029.8.66.2-V: Tax Credit for the Treatment of Infertility

If you or your spouse received in vitro fertilization treatments to help you become a parent for the first time, you might be able to claim a refundable tax credit using form TP-1029.8.66.2-V.

To be eligible:

- You must have been a resident of Québec on December 31, 2022

- You must have paid for eligible expenses in 2022 (keep in mind, you can’t claim expenses you were reimbursed unless the reimbursement was included in your income for the year)

- Neither you nor your spouse had a child before the treatments for which the expenses were paid

- A physician has certified that you and your spouse have not had surgical sterilization by vasectomy or tubal ligation (unless it was for strictly medical reasons)

You can claim the tax credit on a maximum amount of $20,000 for eligible expenses that you or your spouse paid. The tax credit amount will depend on your family situation and income for the year.

Note: If you received advance payments for the tax credit in 2022, be sure to enter the amount in box G from the RL-19 slip you received, on the RL-19 page in H&R Block’s tax software.

If you’re 36 or younger, you can claim the cost of just one in vitro cycle; if you’re 37 years of age or older, you can claim no more than two in vitro cycles. Provided your treatments took place at a licensed clinic in Québec, you can also claim the expenses you paid for medical assessments as well as the cost of prescriptions related to your treatment that aren’t covered by your health insurance plan.

Additional expenses that you can claim include:

- Travel expenses paid to receive treatment (if the treatment facility is at least 80 km away from where you live) and

- Lodging expenses paid to receive medical services that aren’t available in Québec, and located at least 250 km of where you live

You’ll only be able to claim the expenses mentioned above if they aren’t covered by your health insurance plan.

Note: You can’t claim the tax credit on expenses that were reimbursed (or could be reimbursed) to you or your spouse, unless the reimbursement amount was included in your or your spouse’s income and it wasn’t deducted anywhere else on your return.

Tax Tip: In addition to claiming the tax credit for the treatment of infertility, you can also claim your in vitro fertility treatments as a medical expense on your federal return (but not your Québec return).

If your spouse or common-law partner is also claiming the tax credit for the treatment of infertility, you'll need to enter the amount he or she is claiming on their return on the TP-1029.8.66.2-V page of your return. This amount is shown on line 462 (point 11) of their 2022 Québec return.

Note: You can find this amount in their PDF tax return on the SUMMARY page under the Wrap-Up tab in H&R Block's tax software.

Follow these steps in H&R Block’s 2022 tax software:

Before you begin, make sure you tell us you lived in Québec on December 31, 2022.

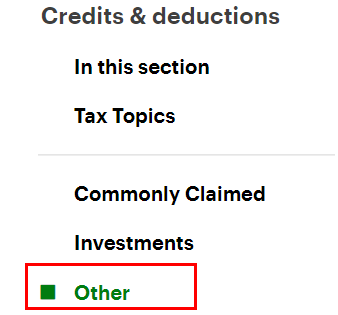

- On the left navigation menu, under the Credits & deductions tab, click Other.

- Under the DISABILITY-RELATED CARE heading, select the checkbox labelled Tax credit for the treatment of infertility (TP-1029.8.66.2-V), then click Continue.

- When you arrive at the page for the Tax credit for the treatment of infertility, enter your information into the tax software.

Note: If you received advance payments for the tax credit in 2022, be sure to enter the amount in box G from the RL-19 slip you received, on the RL-19 page in H&R Block's tax software.