Medical Expenses

Important: Do not enter any medical expense amounts that you’ve already entered in box 85 of your T4 page or box 135 of your T4A page. H&R Block's tax software will automatically claim these amounts for you on your return. You only need to enter, on this page, the medical expenses that you haven’t entered anywhere else on your return.

You can claim medical expenses for:

- Yourself

- Your spouse or common-law partner or

- Your or your spouse’s children under the age of 18

- Your dependants (such as your or your spouse’s child or grandchild over 18, parent, grandparent, brother, sister, uncle, aunt, niece, or nephew) – these are claimed under the dependant’s section in H&R Block’s tax software. Refer to our online help centre article for more information on claiming medical expenses for other dependants.

You can claim medical expenses for any 12-month period ending in 2022 and which have not already been claimed in 2021. For example, for the 2022 tax year, you could claim expenses paid in 2021 and in 2022.

You can claim all or a portion of the medical expenses for which you’ve not been or will not be reimbursed. For example, let's say your health insurance plan reimbursed you for 80% of your medical expenses, you can only claim the remaining 20% on your return.

Note: The medical expenses you’re claiming can’t be used to calculate any other credit, including the disability supports deduction.

Some common eligible medical expenses include:

- Medical services provided by qualified medical practitioners (includes diagnostic, therapeutic or rehabilitative services provided by a medical practitioner acting within the scope of his or her professional training)

- Fees paid to a medical practitioner to complete health and disability forms

- Dentist and dental services

- Prescription drugs and medication

- Medical marihuana, including marihuana plants or seeds, cannabis or cannabis oil if you’re authorized to possess these substances, for your own medical use (under the Access to Cannabis for Medical Purposes Regulations or section 56 of the Controlled Drugs and Substances Act)

- Ambulance service to or from a hospital

- Prescription eyeglasses and prescription contact lenses

- Laboratory tests and x-rays

- Diabetic testing supplies

- Premiums for private health insurance plans, including those you paid through payroll deductions (premiums for mandatory provincial health plans, such as the British Columbia medical services plan, are not claimable)

- Travel expenses paid to access medical services that was at least 40 km away from your home

- Cost to adapt a van to transport a person who needs a wheelchair

- Expenses paid to conceive a child (such as lab tests, cost of medical services, and prescription drugs for fertility-related procedures). Generally, any amounts paid for a surrogate mother are not eligible. If you’re a resident of Québec and paid for in vitro fertilization treatment services in Québec, you can’t claim this expense as a medical expense on your Québec return. Instead, complete the TP-1029.8.66.2-V: Tax Credit for the Treatment of Infertility form to claim the cost of the in vitro fertilization treatments.

Note: Refer to the CRA website for a complete list of eligible medical expenses and the documentation you’ll need to claim these.

The amount you can claim for your medical expenses is the total expenses you paid minus either 3% of your net income or $2,479, whichever is less.

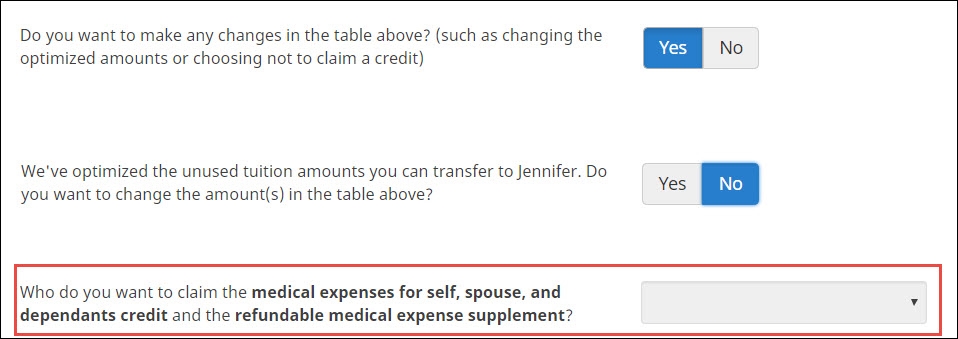

If you are filing a return with your spouse or common law partner, you cannot split medical expense amounts. You can, however, choose who you’d like to claim the entire amount(s).

Tax tip: It is usually more beneficial for the person with the lower income to claim the amount.

To choose who will claim the medical expenses on the Wrap-Up tab, under Final Review, click Optimized credits.

Select Yes in response to the question, Do you want to make any changes in the table above? (such as changing the optimized amounts or choosing not to claim a credit) and then indicate who will claim the medical expenses.

If you’re eligible to claim the federal medical expenses amount, you’re also entitled to claim a corresponding provincial tax credit, which might vary in amount depending on the province or territory you live in:

Yes. According to the CRA, if you or a family member suffer from a prolonged mobility impairment and moved to a house that’s more accessible or functional, you can claim reasonable moving expenses (up to $2,000). Having said that, these amounts can only be claimed as a medical expense as long as they haven’t been claimed as moving expenses on your, or someone else’s return.

If you travelled more than 40 km one way from your home to get medical services, you’ll be able to claim certain expenses as medical expenses on your tax return.

Note: Expenses paid for travel less than 40 km one way are not eligible for this tax credit.

For example, if you travelled more than 40 km but less than 80 km one way to get medical services, you can claim the cost of the public transportation expenses (for example, taxis, bus, or train).

If you travelled more than 80 km one way from your home, you can claim the cost of travel expenses such as accommodations, meals, and parking.

In both cases, you can claim your travel expenses if:

- Similar medical services were not available near your home

- You took a reasonably direct route to get to the medical services

- It is reasonable for you to travel to that place for the medical services

If you also qualify for the northern residents deduction, you might be able to choose how to claim your expenses. Refer to the CRA website for more information on the northern residents deduction.

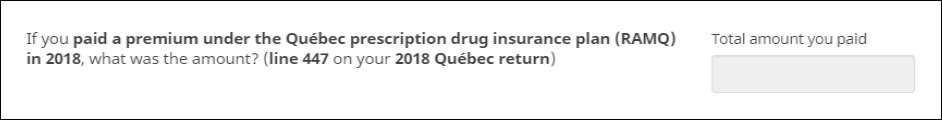

Yes. If you were required to pay premiums for Québec's public prescription drug insurance plan (RAMQ) in 2021, you can claim these contributions as a medical expense on your 2022 federal return. To do this, enter the amount from line 447 of your 2021 Québec return in the field on the Medical expenses page.

Follow these steps in H&R Block’s 2022 tax software to claim eligible medical expenses for yourself or your spouse or common-law partner, or for your dependant child under 18.

You'll only see a difference in your refund or tax owing amount if you have a significant amount of medical expenses. Your medical expenses must be more than $2,479, or 3% of your net income (whichever is less) for the amount to make a difference to your refund or tax owing.

For example, let’s say your 2022 net income is $30,000. On October 1, 2022, you paid $300 for prescription glasses and that was your only medical expense for the year. Since your medical expense is less than 3% of your net income, entering this amount on your 2022 tax return won’t make a difference to your refund or tax owed.

2022 Net income = $30,000

2022 Medical expenses = $300

$30,000 X 3% = $900

$300 - $900 = –$600 -- a negative amount can’t be claimed

However, since medical expenses paid in any 12-month period ending in the tax year are claimable, you might be able to combine the above expense amount with other medical expenses you’ll have next year and claim it on that year’s return.

| October 1, 2022 | $300 for glasses |

| February 10, 2023 | $500 for prescriptions |

| June 5, 2023 | $1200 for dental services |

| Total medical expenses from October 1, 2022 to October 1, 2023 | $2,000 |

2022 Net income = $30,000

$30,000 X 3% = $900

$2,000 - $900 = $1,100 -- your 2023 claimable medical expenses amount

You might see an amount for medical expenses on your return, even if you didn’t enter it on the Medical expenses page in H&R Block’s tax software. This occurs if you paid premiums to a private health services plan through your payroll and this amount was included in box 85 of your T4 slip or box 135 of your T4A slip.

These amounts qualify as medical expenses and H&R Block’s tax software automatically claims them for you when you enter them on the T4 or T4A page of your return.

If you or your spouse or common-law partner received fertility treatment in 2022 from a licensed medical practitioner or infertility treatment clinic in Manitoba, you might be able to claim the Manitoba Fertility Treatment Tax Credit, equal to 40% of the costs of treatment. You can claim up to $20,000 for a maximum of $8,000 per year. There’s no limit on the number of treatments you can claim, as long as the amount claimed isn’t more than the maximum yearly amount.

Note: Either you or your spouse can claim this tax credit but it can’t be split between you both.

You can claim the Manitoba Fertility Treatment Tax Credit if:

- You’re a resident of Manitoba on December 31

- You or your spouse paid for fertility treatments in 2022 and

- The fertility treatment is given by a Manitoba licensed medical practitioner or fertility treatment clinic located in the province

Note: You can’t claim a credit for fertility treatments outside of Manitoba but you can claim any costs from follow-up treatments by a Manitoba physician.

Some examples of treatments that you can claim include:

- Ovulation Induction

- Therapeutic Donor Insemination (TDI)

- Hyperstimulation/Intrauterine Insemination (HS/IUI)

- In Vitro Fertilization (IVF)

- Frozen Embryo Transfer

Keep in mind, this isn't a complete list of eligible treatments. Click here to see which expenses and treatments are eligible.

Note: You can only claim eligible expenses that weren’t reimbursed to you already (for example, by a private health care coverage).

Follow these steps in H&R Block's 2022 tax software:

Before you begin, make sure you tell us that you lived in Manitoba on December 31, 2022.

-

On the left navigation menu, click the Credits & deductions tab and then, the Commonly Claimed heading.

- Under the CREDITS heading, select the checkbox labelled Medical expenses, then click Continue.

- When you arrive at the page for Medical expenses, enter your information into the field labelled Amount paid to a fertility clinic or licensed physician in Manitoba for infertility treatment services.

- Do you have low income and high medical expenses? You might qualify for a separate Refundable medical tax expense supplement. (CRA website)

- Québec medical tax expense supplement (Revenu Québec website)