Top Topics

Find commonly asked questions.

CRA Strike 2023

| Question | Answer |

| Is the CRA going to extend the tax deadline? | As of now, the CRA has not decided to extend the deadline. |

| How long with the strike last? | While the strike started on April 18th, the length of time is indeterminate. At this point, the strike will continue until both sides can agree to a go forward plan. |

| Will my refund be delayed? | Potentially. The best choice is to file as soon as possible. Traditionally, the CRA has processed returns in the sequence it received them so even if there’s a delay, your return would be processed before others who filed later. |

| I need my refund now! | If you have a refund over $600 you can get an Instant Refund in any participating office across the country. |

| Will my government benefits (Climate Action Incentive, GST/HST, Child Tax Benefit, etc.) be delayed? | Potentially. The best choice is to file as soon as possible. Traditionally, the CRA has processed returns in the sequence it received them so even if there’s a delay, your return would be processed before others who filed later. |

Current Top Topics

All packages allow you to start for free, meaning you can work through your entire return and enter all your information without having to pay immediately. However, packages are priced based on return complexity; the slips entered in the tax software will determine which package the return falls under.

If the DELUXE, PREMIER, or SELF-EMPLOYED option has been recommended, this means that the return likely doesn’t qualify for the FREE software package, and the recommended package will need to be purchased before you can NETFILE your return.

If you had COVID-19 Benefit repayments, you would have received a T4E slip. Depending on the amounts in Box 26 and Box 30, questions will appear in the software, and you’ll need to answer these questions and fill in the amounts.

Repayments to HBP won’t show up in the summary, it’ll only appear on Schedule 7 found on the full PDF of your return.

If you received the message “unable to NETFILE – account locked”, this means that you’ve exceeded your number of attempts to NETFILE, and the Canada Revenue Agency (CRA) has locked your account.

To fix this, you’ll need to contact the CRA at 1-800-959-8281 to unlock your account. Afterwards, review your return and make sure there are no errors, then attempt to NETFILE again.

If you’re using the auto-fill option and your marital status has changed, you’ll need to start a new return. This field can’t be edited when carrying over your previous information.

Note: Don’t forget to also update your marital status with the Canada Revenue Agency (CRA) as your information must match what the CRA has on file to NETFILE.

If you are receiving this error message, please check and compare if the personal information from your Notice of Assessment last year is the exact same as what is in the software this year. Common issues to look for:

- Name – Spelling of First and Last name

- Middle initial

- Middle name

- Date of Birth

- Did your name change from last year?

- Did your marital status change from last year?

All the issues above could cause the error you see on the NETFILE page.

If you choose to mail in your return, you must print the file and send it to the Canada Revenue Agency (CRA) office closest to you. The following table lists which cities and provinces can mail to what office:

| CRA Office | Returns Types Processed | Cities and Provinces |

|

Winnipeg Tax Centre Post Office Box 14000, Station Main Winnipeg, MB R3C 3M2 Local and long-distance calls: 1-800-461-1806 Fax: 1-833-494-1381 |

T1, T2 and T3 |

|

|

Jonquière Tax Centre 2251 René-Lévesque Blvd Jonquière, QC G7S 5J2 Local and long-distance calls: 1-855-699-4640 Fax: 1-833-474-0425 |

T1 and T2 |

|

If you’re new to using our software or doing your taxes yourself and you’re not sure that you’ve filled in everything correctly, we have an add-on that can be purchased within the software to help you! We have two available options with our Expert Help service, you can:

- Request a call to chat with a Tax Expert and ask questions while you work through your return.

- Book an appointment to have the option to book an appointment with one of our Tax Experts and have them review your return prior to filing.

If you have “warnings” at the end of your software experience, prior to filing - this won’t prevent you from filing your return. The “warning” messages are simply a reminder that some of these items might need a second look to make sure you haven’t missed anything. If you’ve double checked that the information is correct, you can either fix the warning or ignore the warning and proceed to file your return.

If you need help filling in your employment expenses, we have some great articles within our Online Help Centre. Within the software, choose Online Help Centre, and search “employment expenses”, you’ll then find a few helpful articles that will guide you through it and answer any questions you may have.

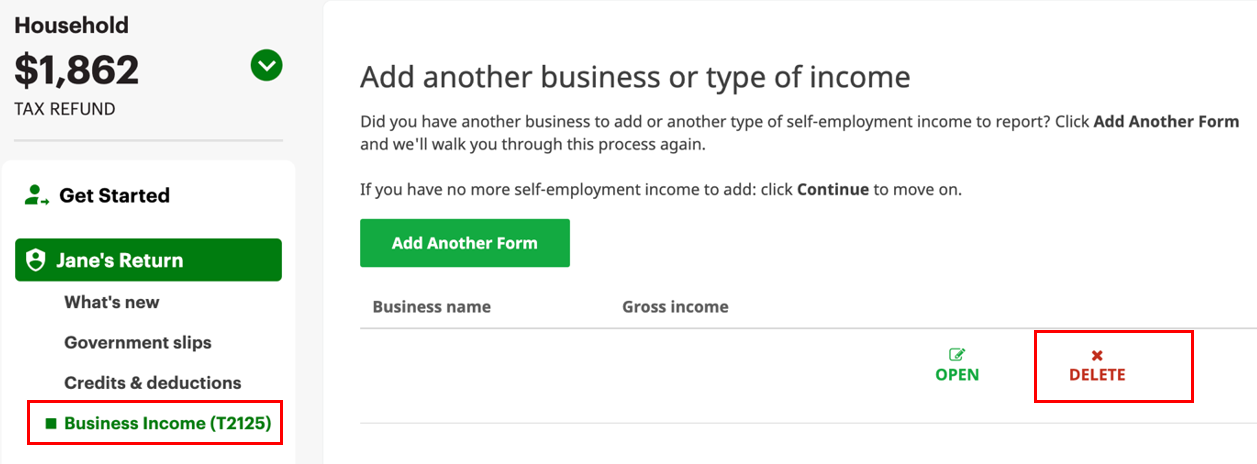

- If you’re being prompted to upgrade to PREMIER package, please accept the upgrade.

- Once you’ve upgraded to PREMIER, log out and log back in.

- Reopen your return and navigate to Credits & deductions. Click Employment and ensure Statement of business or professional activities (T2125) is checked.

- Navigate to the Business Income (T2125) section and remove last year’s Self-Employment entries.

- Proceed with filing your return.

Previous Top Topics

Software packages are priced based on return complexity; the slips you enter in the software will determine which package you fall under. If you have been recommended the deluxe or premier option, this means that your return likely doesn’t qualify for the free software package. Click here, to learn more about what’s included in each software package. However, if you’re 25 and under, all packages would be free, click here to learn more about this offer.

If you've added a service to your software package, you will not be able to remove it and you'll have to start a new return.

We do not offer any refunds. Please read our 2022 Terms and Conditions to know more.

Returns that have already been started can’t be deleted, create a new return if you’d like to start over.

A copy of your T1 General tax return can be found within H&R Block's tax software:

- under the Wrap-Up tab, then click SUMMARY.

- at the end of the tax return (under the File tab).

If you’ve received an NOA/NOR and you’ve purchased our Audit Protection service, we can help. Please call us at 1-800-472-5625 and we’ll be happy to guide you through the next steps.

If you need to make changes to your return after you’ve NETFILED, you can still do so by using the REFILE option. Once you start making the changes within the software, you’ll receive a prompt asking you if you’re sure you want to make changes, continue along and make all the necessary edits. Afterwards, you may REFILE any corrections/changes to your return.

If you forgot your login credentials, you can still access your account. On the login screen, underneath the Sign In button, find the I forgot my username or password section. Depending on the credential forgotten, click either:

- Username

- Password

Important: Only if the answer to the security question is forgotten, then a new account will need to be created using a new email address.

Within a return in the DIY tax software, you can find the Help Centre by:

- On the top right navigation menu, click Support.

- Click the link to support.hrblock.ca under the H&R Block help & support section.

Some helpful articles about expenses:

Our Expert Help service is an add-on available for all clients who are using our DIY tax software and require extra help while preparing their return. We have two options available when you purchase our Expert Help service:

- Request a call to chat with a Tax Expert and ask questions while you work through your return.

- Book an appointment to have the option to book an appointment with one of our Tax Experts and have them review your return prior to filing.

To purchase Expert Help:

- From within a return in H&R Block's tax software, purchase Expert Help by clicking LEARN MORE under NEED TAX ADVICE? in the left navigation menu of your online return.

- Click Add Expert Help.

A new return will need to be started if the martial status was entered incorrectly. This is due to the selection being locked in and uneditable.

Within a return in the DIY tax software, you can find the Help Centre by:

- On the top right navigation menu, click Support.

- Click the link to support.hrblock.ca under the H&R Block help & support section.

Using the search function, type in the content you are looking for to find articles about Cryptocurrency and other slips.

Some articles about Cryptocurrency are listed below:

A high-level comparison of packages can be found in a table on our software page. Here you can compare packages customized to your needs and explore add-ons provided by H&R Block Canada.

The NETFILE Access Code (NAC) is an 8-character code that is used as an added security measure by Canada Revenue Agency (CRA) to verify your identity when you NETFILE your return.

It can be found on your last year’s Notice of Assessment (NOA). For more information, see Where can I get a copy of my notice of assessment (NOA)?

Your NETFILE access code can be entered on the Get Started page in the About You section of the software. You can find your code on your previous year’s Notice of Assessment (NOA).

However, when filing with our software, this is not a mandatory field. If you don’t have your code, you can continue to file without it.

Information about be found Northern Residents Deductions can be found in this help article, Northern Residents Deductions (T2222 and TP-350.1-V).